Federal Tax Rate On Social Security Benefits 2025

Federal Tax Rate On Social Security Benefits 2025. Single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their social security benefits. The maximum social security benefit for 2025 is expected to be $3,822 per month at full retirement age.

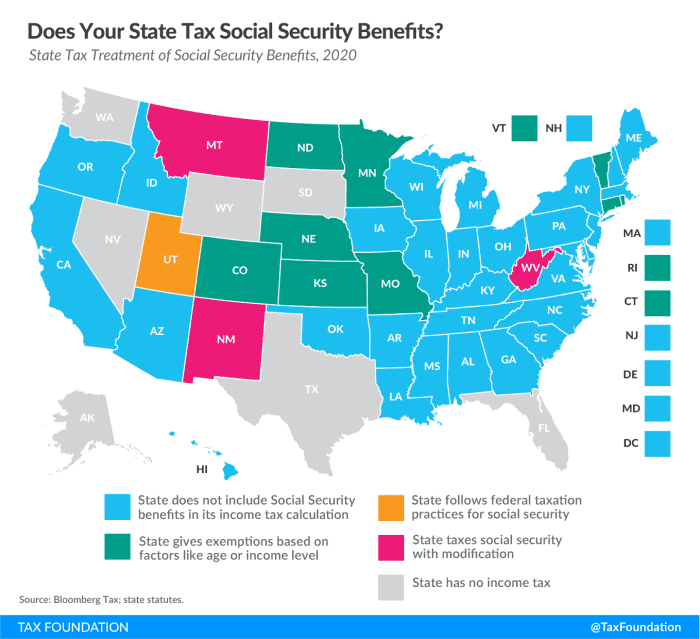

And kansas social security beneficiaries can opt out of state taxes as long as their adjusted gross income is below $75,000. You file a federal tax return as an individual and your combined income is more than $34,000.

And Kansas Social Security Beneficiaries Can Opt Out Of State Taxes As Long As Their Adjusted Gross Income Is Below $75,000.

Social security benefits are subject to federal income tax when combined income exceeds certain thresholds.

Social Security And Medicare Tax For 2025.

Will you pay taxes on your benefit in 2025?

For Sure, This Is A Good Amount.

Images References :

Source: www.youtube.com

Source: www.youtube.com

How To Calculate, Find Social Security Tax Withholding Social, How state governments tax social security benefits. Getty images) by katelyn washington.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Paying Social Security Taxes on Earnings After Full Retirement Age, How state governments tax social security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your social security benefits.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2025 year of assessment Just One Lap, Employers deduct the tax from paychecks and match it, so that 12.4% goes to the. Up to 85% of your social security benefits are taxable if:

![Social Security Wage Base 2021 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png) Source: www.uzio.com

Source: www.uzio.com

Social Security Wage Base 2021 [Updated for 2025] UZIO Inc, The social security wage base limit is. Last updated 12 february 2025.

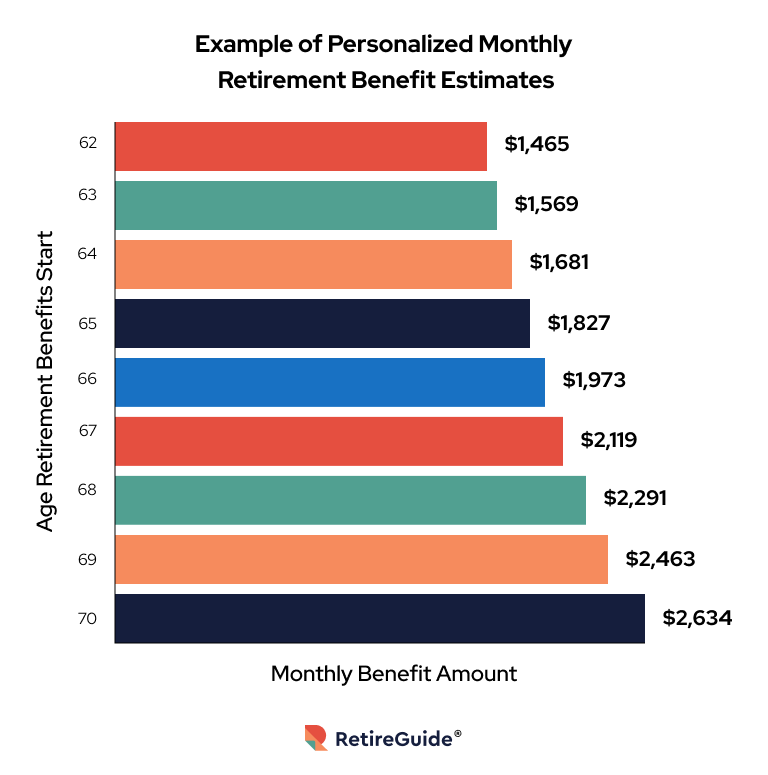

Source: www.retireguide.com

Source: www.retireguide.com

Social Security Retirement Benefits Explained, For sure, this is a good amount. Employers deduct the tax from paychecks and match it, so that 12.4% goes to the.

Source: www.marketwatch.com

Source: www.marketwatch.com

37 states don't tax your Social Security benefits — make that 38 in, As we approach april 15, let’s discuss the federal taxation of your social security benefits. Will you pay taxes on your benefit in 2025?

Source: www.taxablesocialsecurity.com

Source: www.taxablesocialsecurity.com

Calculate Taxable Social Security Benefits 2025, The social security tax reaches its ceiling at $168,600 in wages (adjusted annually for inflation) because any wages earned above that level no longer earn. Meanwhile, missouri seniors don't pay taxes if bringing.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, Employers deduct the tax from paychecks and match it, so that 12.4% goes to the. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Source: www.forbes.com

Source: www.forbes.com

Social Security Checks To Get Big Increase In 2019, File a federal tax return as an individual and your combined income* is. The social security administration estimates that 40% of.

Source: medicare-faqs.com

Source: medicare-faqs.com

What Is The Social Security And Medicare Tax Rate, File a federal tax return as an individual and your combined income* is. It doesn't mean 50% of benefits are paid in taxes.

If Your Combined Income Is More Than $34,000, You Will Pay Taxes On Up To 85% Of Your Social Security Benefits.

The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each.

The Maximum Social Security Benefit For 2025 Is Expected To Be $3,822 Per Month At Full Retirement Age.

Will you pay taxes on your benefit in 2025?